The Royal Bank of Scotland:

Future Bank 2025

How will generation-Y's 'new values' effect the type of services and relationship they have with their bank in 2025?

Project Context

The brief given by the client (RBS design team) was to “test some of RBS’s ways of working in combination with our own methods to analyse the values of current 16-25 year olds and translate their existing behaviour into emerging forms of user experiences appropriate to the future context of the UK in 2025.”

.

To address the many facets of this brief we formed several domain brief groups. Our particular interest was generation- Y's 'New Values' with designers, Lizzie Abernethy, Ottavia Pasta.

As a result this project employed qualitative research to future forecast the world in 2025, which then informed alternative future services and a new type of relationship with the bank's future clients.

Reframing The Brief

How will generation-y's New values effect the future of Financial institutions such as RBS?

The brief for 'New Values' indirectly referenced both definitions of value we explored through a mind mapping session to launch the project (value as a currency and value as a belief system). We then spent the rest of the first phase of the project re-framing our brief into three design questions we felt addressed the needs of both clients; their users and RBS themselves as a business.

What New Forms of Value do generation y utilise

– Addressed in Phase 1

What are the different types of valued capital that can now be quantified, exchanged and monetised; social, knowledge (experiential, data) material, cryptocurrencies, local currencies etc?

how are generation y's New Values changing their idea of a bank– addressed in Phase 2

How are Generation Y’s values changing the way they do things such as earning & what financial services will be needed in the future?

What new relationship would generation y like with their bank – addressed in Phase 3

What are Generation Y’s new values and how do they affect their relationship with the bank? What does Generation Y perceive the role of the bank to be?

Phase 1

Future Trends

Creating STEP Cards from Desk Research

The project comenced with two weeks of intense desk research which we processed into 100 STEP cards (25 from each domain) illustrating each groups key incites into influential trends on generation-y and finance. Together we created the template for these step cards with three objectives in mind; (1) To bring clarity and communicate the possible directions for each domain, (2) to project these influential indicators ten years into the future in order

to visualise the world in which RBS's future services would provide and finally (3) harmoniously format each groups key findings allowing us to compare and contrast relationships between each domain as even our future world will be wickedly interconnected. To ensure our research had covered every sphere of influence we categorised each trend into (S) Social, (T) Technological, (E) Economic, (P) Political, indicators.

STEP Card Synthesis

Ethnographic Research

Interviews

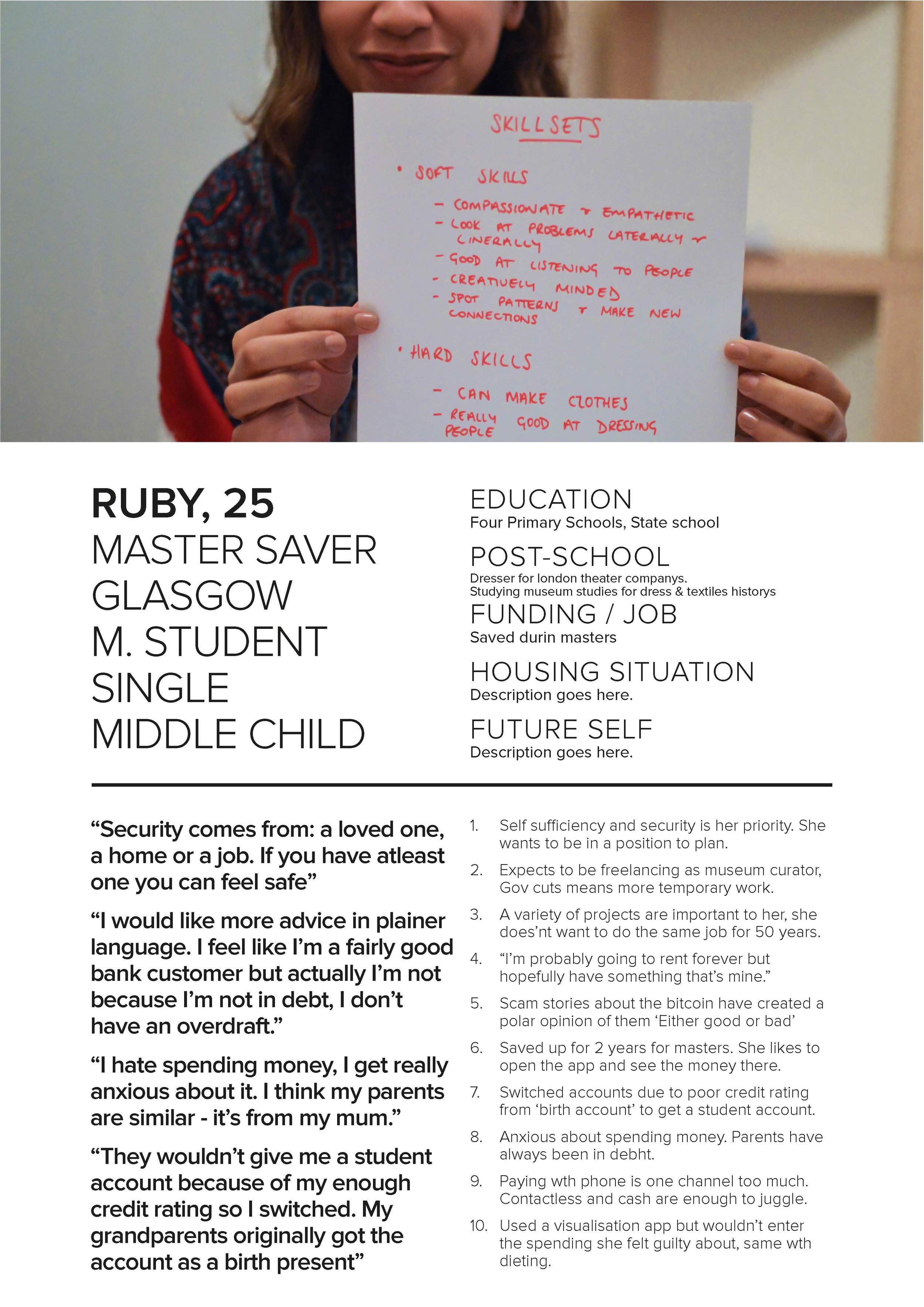

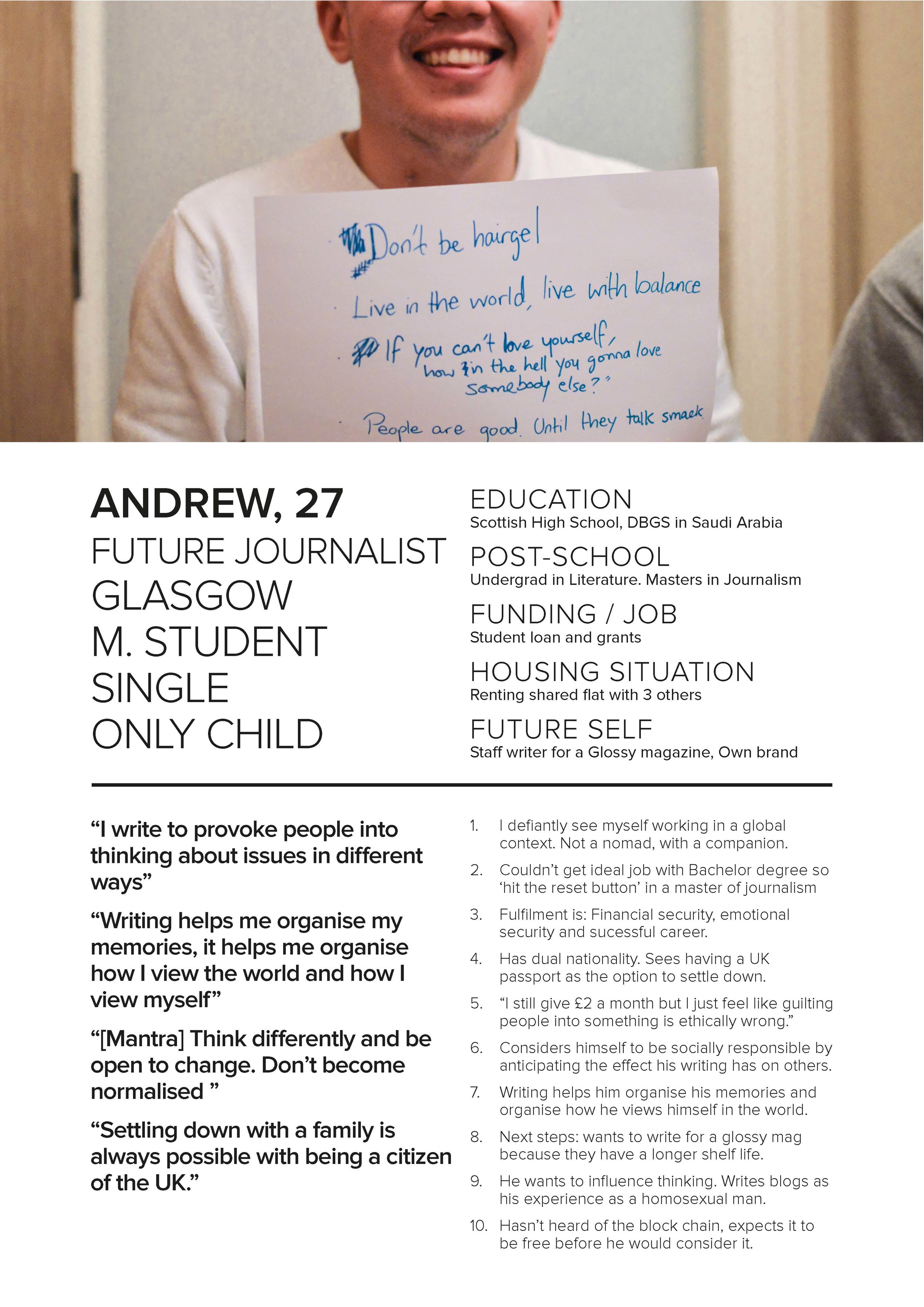

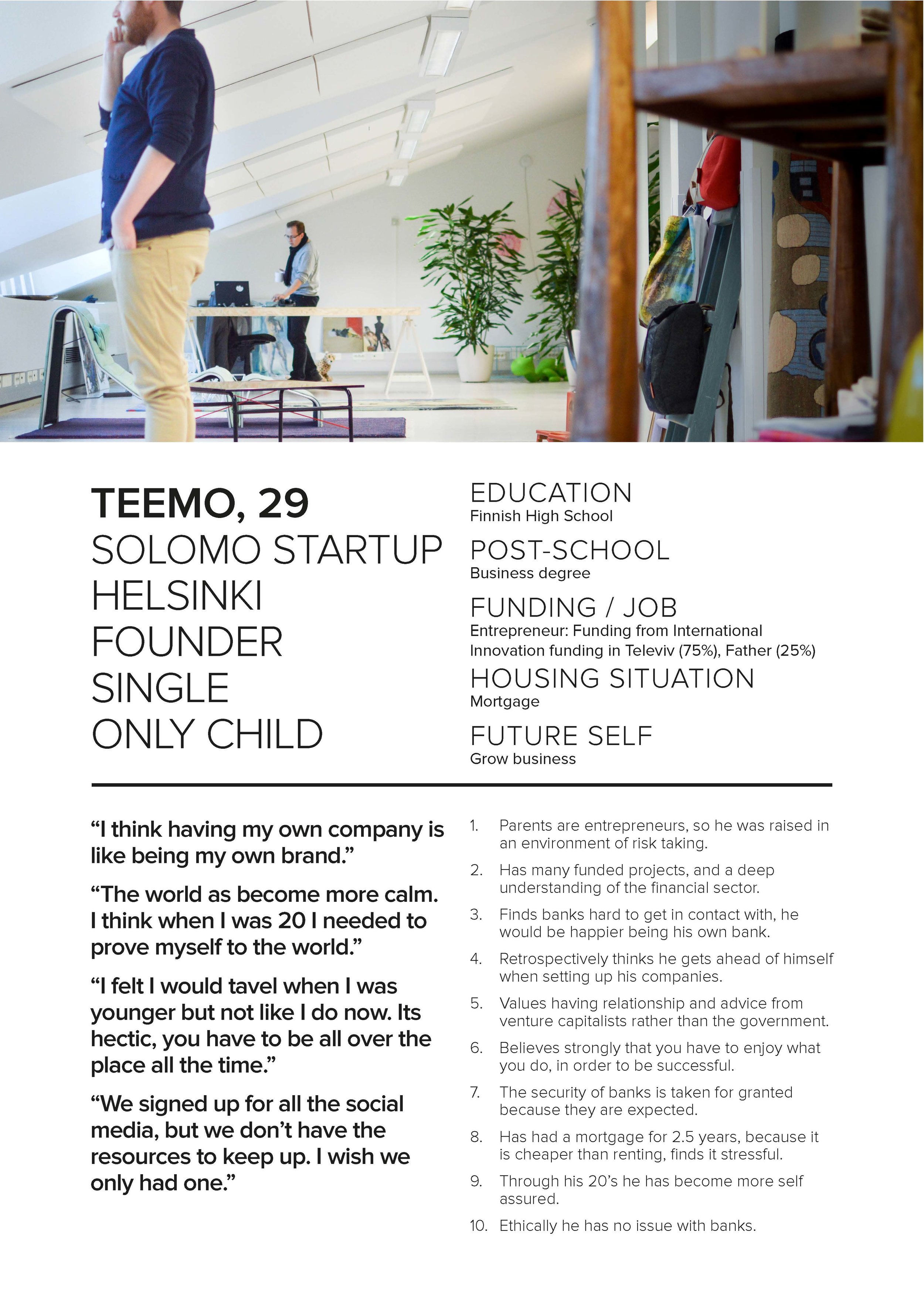

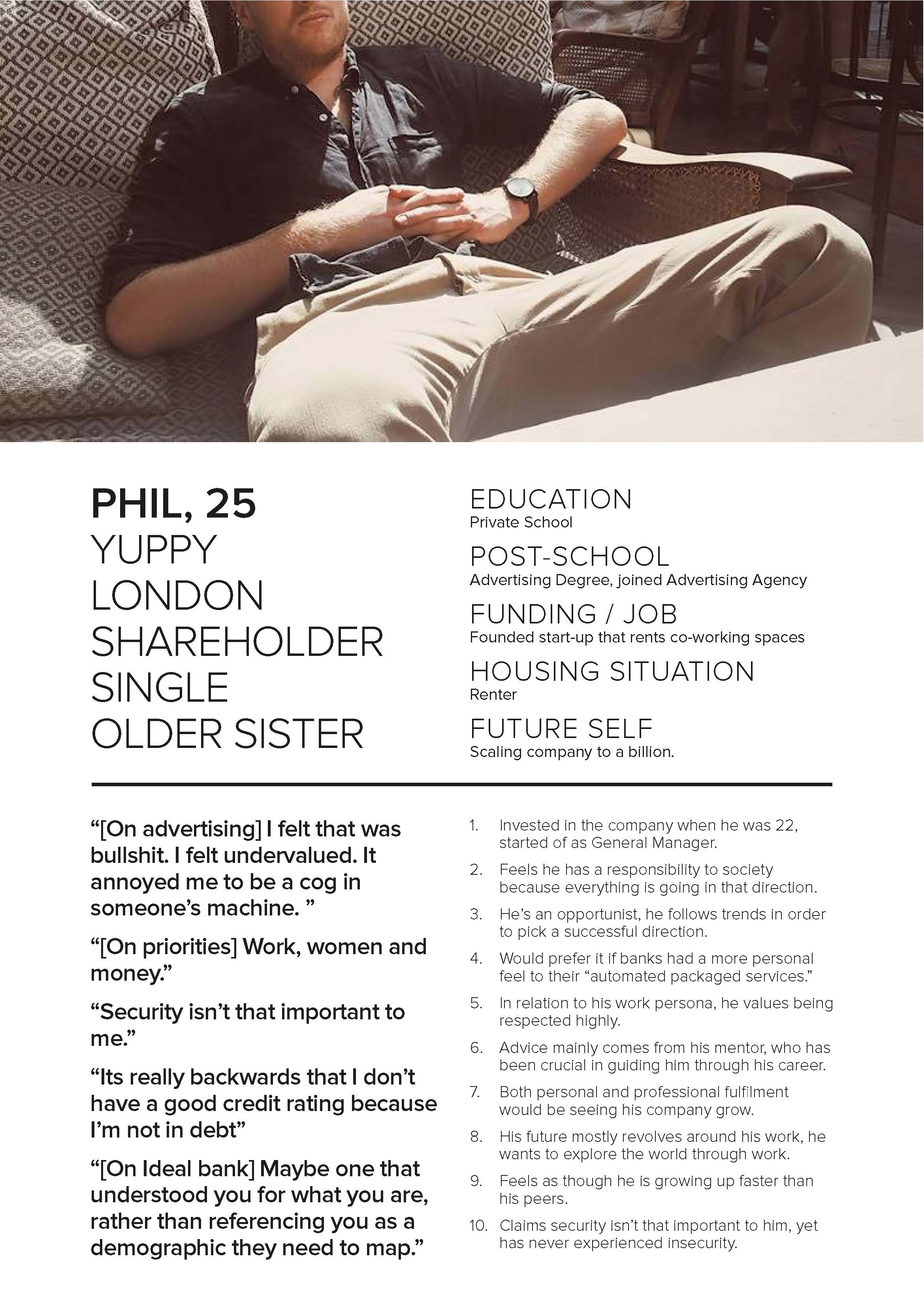

In order to gain a more human perspective of Generation-Y each group recognised several subculture groups directly related to their domain brief for interviews. New values were specifically interested in those who valued different forms of capital for a living such as; volunteers, entrepreneurs, social media enthusiasts, and gamers. After 1-2 weeks of interviews each domain group came together to format the key insight into a comparable template for everyone resulting in 52 interview posters.

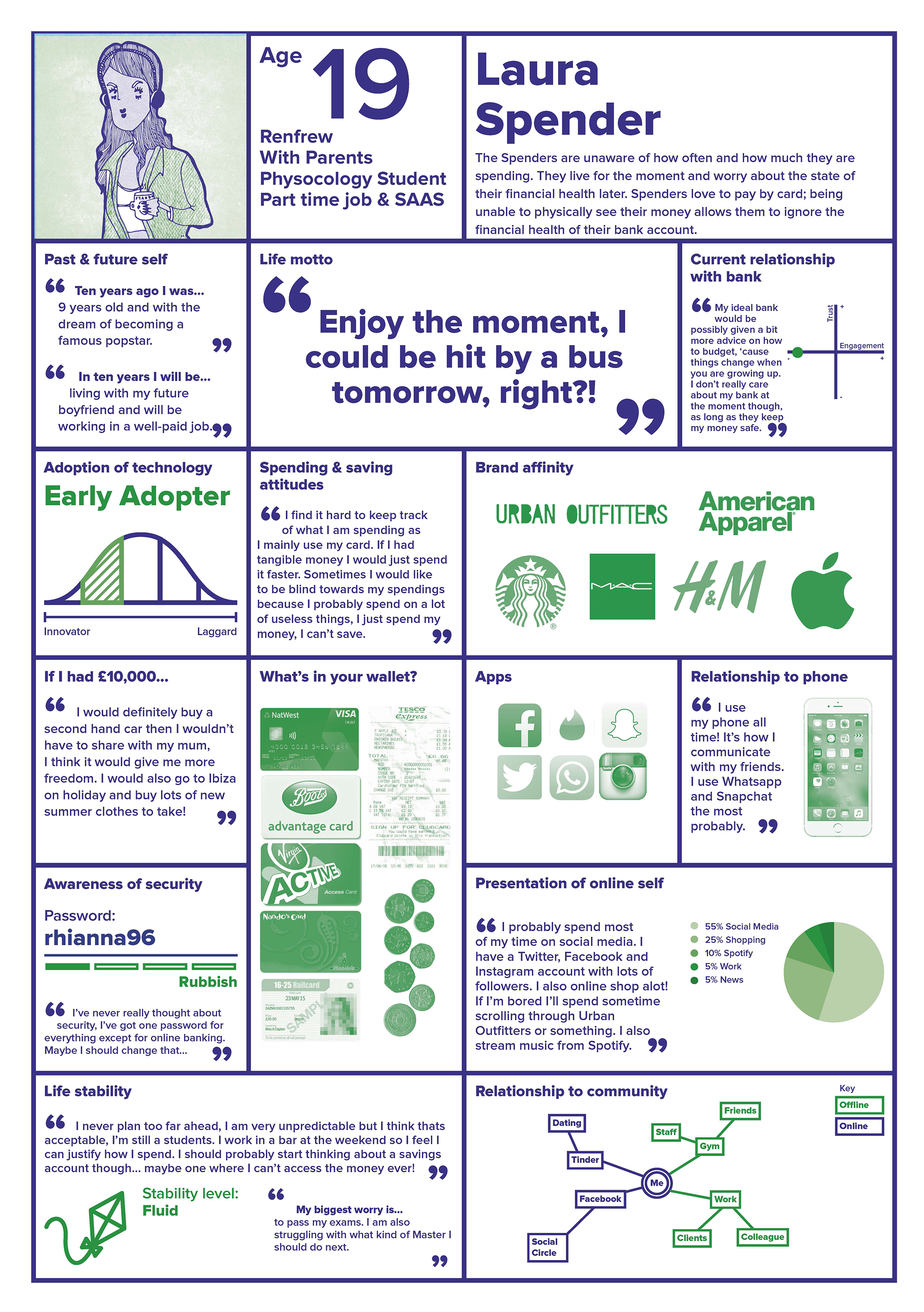

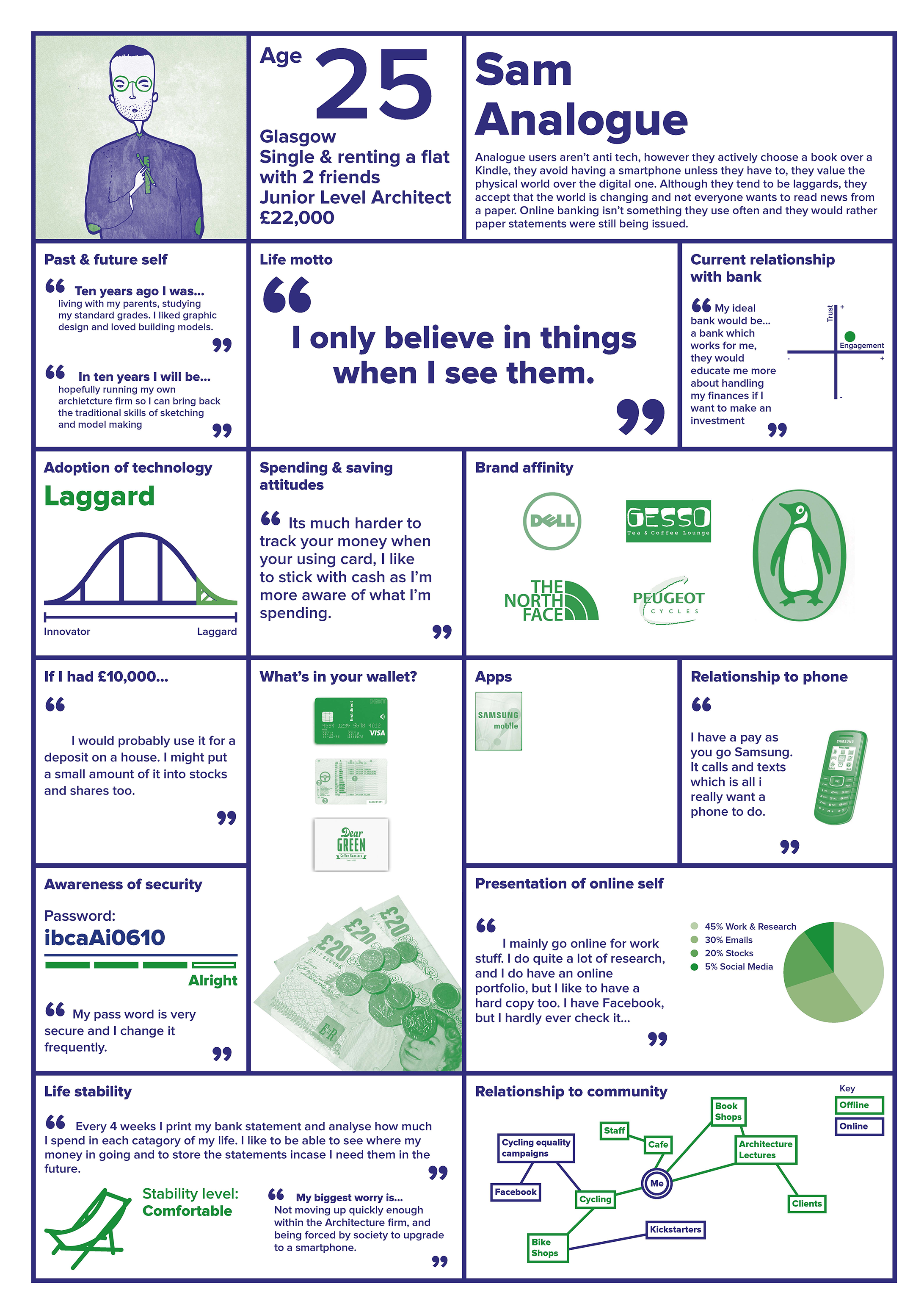

Tribes & Chiefs

In order to translate these 52 interviews into a useful design tool, we clustered the interviews according to patterns of behaviour towards finance. We were sure to create a persona template that informed each domain brief resulting in 12 useful personas to represent Generation-y and their relationship with financial services. According to the New Values brief we were keen to recognise members of Generation-Y who enjoyed a broad range of values not currently catered for by the banks of 2015.

Future World 2025

Using the step cards as future indicators from all domain briefs we speculated what this future world would look like in the UK 2025. Our team then used this to spot opportunities for services we felt would be needed in such a world. Like the STEP cards each insight could be categorised into Social, Economic, Political and Technological factors.

Future Opportunities

Despite the fact the bank would need a new relationship with their next generation of customers, the future world brought up several more practical services that Generation-Y would need to survive in the future. To do this we also looked at the banks existing services (2015) and correlated them with future trends of 2025 to see how they might need to adapt to provide valued services.

These informed the 6 concept services that embodied a new ideology which we hypothesised would bring the bank values closer to their customers. The following opportunities were used to generate future service concepts:

Lending services

2015 - Credit ratings currently allow the bank to evaluate whether a customer can pay back the loan according to their monetary assets and little else. This opaque binary metric creates a very narrow ground for a relationship.

2025 - Trying to understand the inner working technology and system of a company used to be like looking into a black box. Future technology such as the Block Chain may quantify the full range of the customers assets giving a more complete and transparent reflection of themselves.

Altruistic services

2015 - Time Banks are backed by the Government verbally but in practice they are considered a tax dodge: There is no way of taxing currencies that could make a community more sustainable. Altruist actions are not valued on your credit rating.

2025 - It is unlikely the Government will be able to afford to aid communities as it moves into more preventative policies. In addition millennials are forming communities according to their ideals to champion the changes they want to see within their local spaces.

Earning services

2015 - Without an income your Credit Ratings cannot improve. You’re not assessed on your potential but only your current situation.

2025 - Money making should be meaningful and the bank helps you earn as well as spend and lend. Credit ratings are assessed on your skillsets not employment.

Advisory services

2015 - When unplanned changes occur going to branch or calling your bank takes time and can be frustrating. The bank will present you with various options rather than specific advice. For more tailored advice you have to pay for a Financial Advisor. Furthermore bank rarely provide any advice on budgeting or money management.

2025 - Corporate Social Responsibility (CSR) will move from a marketing strategy to core ethics to achieve loyal customers in a competitive future.

Investment services

2015 - To get a loan SME businesses need a good credit rating and prove there is a need in the market as well as giving realistic cash flow forecasts. This is evaluated by financial experts only. Large loans are incredibly risky specifically to the bank and is why venture capitalists are more likely to invest in new companies.

2025 - The internet has created more connectivity allowing Generation Y to set up their own companies more easily. With more direct channels to their customers it will become easier to evaluate and quantify ideas according to those who value them.

Saving services

2015 - A savings account is place to drop cash and earn interest as a reward for 'saving' with that bank. Strict laws now govern any investment schemes the bank may use to gain that interest.

2025 - Economic inequality and no state pensions plan will make saving the responsibility of individuals making this a prime opportunity for serious CSR.

Phase 2

Future Strategy

We believe Generation-Y would only trust the bank with the aspects of their lives they would need future financial help with if they shared compatible values. Our research lead us to two key insights: (1) Generation-Y found it difficult to trust a bank that benefited from their misfortune, we called this metaphor 'a wolf in sheep’s clothing.' (2) Generation-Y had a 'hygienic relationship' with their bank as they did not share the full spectrum of values that Generation-y held but rather confined themselves to rewarding behaviours that were backed by more traditional conservative values.

RBS Umbrella ideology;

A mutually beneficial relationship

In order to address these fundamental trust issues we questioned whether it would be possible to turn the banks monetisation strategies on its head; so when the customer won, so did the bank. Instead of making money from their customers misfortune (liabilities) what if the bank was to create valuable services that benefited from their customers fortune (assets)? This would truly hold them accountable to their CSR new role as educators as they would literally put their money where their mouth was. In doing this we hoped to create a more transparent and mutually beneficial relationship between the bank and their customer. Our hypothesis was that customers wanted to stay in the black and would be willing to pay for it. This ideology formed the umbrella strategy for the future services we proposed as concepts.

RBS Future Services

After many iterations we settled on 6 future services that embodies the banks new ideology. Each service would address a future need, and reflect a diverse range of values and forms of capital Generation-Y enjoy. As we expected peer to peer systems such as the Block Chain to feature in the future world, we connected these services to interact with the customers own Block Chain account. One benefit of the Block Chain is its ability to document all forms of value such as; social, material, monetary, knowledge, and even cultural capital. The customer would own their data so as a result the role of the bank would be to manage and make the most of their customer’s assets - in a mutually beneficial fashion. This broader variety of data would also act as an interface between the customer and user affording a richer relationship.

Artefacts for user testing:

We created two main artefact to provoke and test our concepts;

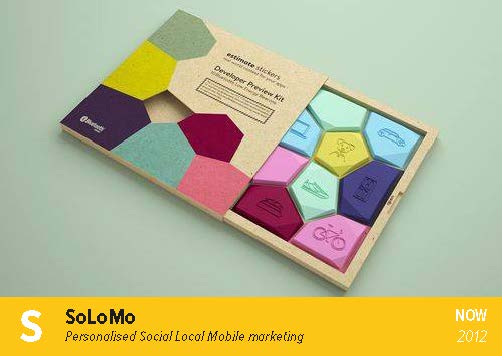

1. Generation-Y valued a range of values not currently catered for by the bank. To identify these were we created a values framework called the 'values wheel'.

2. In order for the bank to take advantage of future opportunities for services, we created an 'account builder' comprising of the possible future services with each adopting a more mutually beneficial offering for our test subjects to build their account with.

Account Builder - Future Services

Artefact:

The account builder aids the creation of a customer’s bank account by choosing which services they valued. Each service interacts with the data on their Block Chain. Subjects choose a maximum of three triangles to represent the services importance.

Objective:

We used this tool to identify the most popular services according to the function and value it embodied. By recognising each testing participant’s persona we were also able to explore whether they found the services useful according to their need. A physical object slowed down the selection process allowing us to deconstruct the meaning of each decision whist the participants made it.

Values wheel - future Relationship

Artefact:

This is an adaptation of Shalom Schwartz’s societal values wheel. Every individual, institution and culture can be mapped on this wheel. We asked our subjects to value their current bank then the values of their ideal bank and finally their personal values.

Objective:

We used this to understand how Generation-Y currently perceive the bank. We then compared this with the values of their ideal bank to identify the differences. By comparing their personal values to their ideal bank to identify Generation-y’s ideal relationship with the bank.

Phase 3

User Testing Workshop

User Testing Analysis